Are you confused about AMP and the Flexa network? If so, don’t worry – you’re not alone! This article will demystify these two topics and provide a comprehensive overview of what AMP does on the Flexa Network, an innovative payments processing platform. You’ll also learn how to use it quickly and easily and get insights into its potential applications.

After reading this guide, you should better understand how AMP can help your business succeed both online and offline. So whether you are an entrepreneur or in charge of managing corporate finances, start reading now to become proficient with the latest payment technology from flexa!

Flexa Network and Amp Token Overview

To grasp the mechanics of AMP, we must first understand the workings of Flexa Network, a crypto payments platform that serves as the foundation of the protocol. Founded in 2018 by a team including Tyler Spalding and Trevor Filter, Flexa provides an easy, quick solution for crypto payments online and in physical stores.

Through their payment app, SPEDN, users can spend Bitcoin, Ether, Litecoin, and other cryptocurrencies at over 40,000 merchants in the United States and Canada. The native token of the network, FlexaCoin, is used for transactions and incentivizing user adoption. As an open network, Flexa is poised to continue its growth within the crypto community, enabling wider adoption of digital currencies in mainstream commerce.

Flexa Network’s recent upgrade from FXC to the Amp token is a significant move towards addressing the critical issue of crypto payment security for merchants. With the current proof of work blockchain, it can take up to several hours for confirmation of a payment received by merchants. However, the switch to proof-of-stake blockchains may leave the networks vulnerable to attacks.

The Amp token (AMP) is an innovative digital collateral token that aims to revolutionize the world of cryptocurrency transfers. As an ERC-20 compatible token, it offers unrivaled interoperability with external transaction protocols, making it a versatile asset for real-world use cases such as merchant payment transfers and decentralized finance (DeFi) transactions. One of its biggest strengths lies in its fixed maximum supply of 99,445,806,961 tokens, which protects its value from inflation.

The Flexa Network created amp tokens to overcome the shortcomings of FXC’s smart contracts, whose infrastructure couldn’t support more advanced functionalities. In September 2020, FXC holders were offered Amp tokens at a 1:1 exchange rate, further increasing its liquidity. Overall, the Amp token represents an exciting opportunity for individuals and businesses looking to take advantage of the benefits of blockchain technology. Its adoption by new companies will only increase its value for existing users.

How Does Amp Work?

The Amp token’s open-sourced nature has made it an attractive option for merchants and companies seeking to incorporate a crypto payment gateway into their daily operations. Its fundamental purpose as collateral for crypto transactions, particularly those made through SPEDN or other apps that use Flexa’s payment protocol, has made it essential to maintain collateral integrity.

Users can stake AMP to help balance collateral pools, ensuring smooth value exchange in digital payments, loan distributions, and property sales. As a result, AMP promises to be a reliable and stable option for anyone seeking to incorporate crypto payments into their business.

When it comes to staking AMP, there is a key rule to keep in mind: the amount of AMP spent cannot exceed the total amount of AMP staked in the Amp collateral pool. This is a crucial aspect of the staking process as it ensures that the collateral pool is always fully backed for any transaction that may occur.

However, it’s important to note that as the amount of AMP spent approaches the amount of AMP staked in the collateral pool, the rewards offered will increase significantly. This incentive structure is designed to attract users to various collateral pools, which naturally balance out over time, resulting in a healthy equilibrium. As more users are drawn in by the opportunity for higher rewards, the pools will become more balanced, ensuring a stable and sustainable ecosystem for all involved.

Creating a collateral manager can be a powerful tool when it comes to using AMP as collateral. Essentially acting as an escrow account, this manager can be customized to fit specific needs and purposes. Moreover, with Amp’s token contract, token partitions allow multiple collateral managers to enforce different rules on separate areas, all linked to the same digital address. This means that staking AMP doesn’t need to involve transferring it to another smart contract. By utilizing these features, anyone can take advantage of AMP collateral’s flexible and customizable nature.

What Is Amp Used For?

AMP is a versatile cryptocurrency that serves a variety of functions for its users. One use case for Amp is staking. By staking their Amp tokens, users can earn rewards in the form of re-purchased AMP. The best part? There are no lock-in periods so users can access their tokens at any time.

In addition to staking, Amp can also be used for governance. Through Snapshot, a gas-free voting platform for crypto communities, Amp users can vote on community proposals and have a say in the future direction of the Amp protocol.

How to Stake and Unstake Amp?

As the popularity of decentralized finance continues to grow, so does the demand for efficient and secure staking platforms. For those looking to stake AMP tokens, the Flexa Capacity App serves as the main platform for doing so. However, there are other reliable DeFi platforms that support staking AMP, such as Uniswap and Balancer, as well as popular wallets, including MetaMask and Trust Wallet.

By diversifying staking platforms, investors can mitigate risk and maximize their potential rewards. With a little research and due diligence, staking AMP can be a lucrative and rewarding venture for those willing to take the plunge into the exciting world of decentralized finance.

Staking your AMP tokens on Flexa Capacity App is easier than you might expect.

- The first step is to connect your wallet to the app, which can be easily done with one of six popular choices, including MetaMask and Coinbase Wallet.

- Once connected, select from the available staking choices, and the total balance of your AMP tokens will be displayed.

- Select your preferred protocol and the amount you wish to stake, then click ‘Continue’.

- Once the transaction is completed, your updated balance and rewards will be displayed within the app.

Steps to Unstake Amp

Unstaking your AMP tokens is a simple and straightforward process.

- To begin, connect your wallet, go to your AMP balance page, and click the Move button next to any staked asset.

- You’ll need to select the number of AMP tokens you’d like to unstake before clicking Continue and waiting for your collateral to unstake.

- Depending on whether or not your AMP is being used to collateralize a crypto transfer or if the Ethereum network is busy at that time, it could take anywhere from minutes to hours for the process to complete.

- Once confirmed, you can select ‘Move To Wallet’ to return those tokens to your wallet – after which you can view them with the updated amount reflected in your total balance.

Following these steps will ensure you can safely unstake some or all of your AMP tokens whenever necessary.

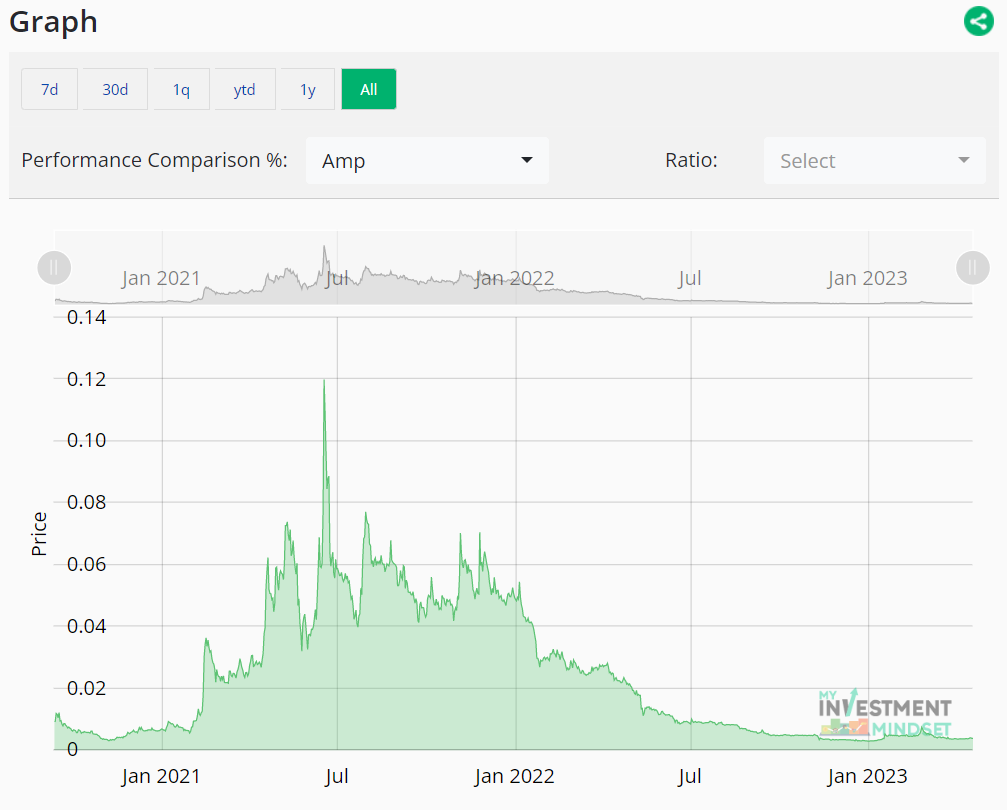

AMP Pricing

AMP, a cryptocurrency, was launched on Sep 9, 2020, at an initial price of $0.009. It remained stable for several months until the end of January 2021, when it began rapidly climbing, peaking at $0.036 on Feb 14, 2021. Despite slightly retracing, AMP’s price surged from April onwards, reaching local highs of $0.06 on Apr 19 and $0.07 on May 9. However, the price quickly plummeted, dropping to a support level of $0.03 by May 24.

In early June 2021, AMP was listed on Coinbase, causing its price to soar to it’s all-time high of $0.12 shortly after June 16, 2021. Although the high could not be sustained, the price remained relatively stable at a support level of $0.04 by Jul 21. As with any cryptocurrency, the prices of AMP are subject to constant fluctuations, making it an exciting yet volatile investment opportunity.

AMP had a rocky 2021 with several peaks, but things turned for the worse in January 2022 when the price broke its support level and went downward. The cryptocurrency eventually stabilized at around $0.003 by the end of the year.

However, there seems to be light at the end of the tunnel as AMP started showing signs of growth in mid-January 2023 and currently trades at $0.005. As with any cryptocurrency, there are bound to be ups and downs, but it’s reassuring that AMP is slowly but surely making a comeback. As always, it’s important for investors to stay vigilant and do their research before making any decisions.

The AMP token has garnered attention in the world of cryptocurrency as a potential investment opportunity. Price Prediction and Digital CoinPrice offer differing forecasts of the token’s value, with Price Prediction predicting a significant surge in value by 2030.

Their analysis predicts AMP could reach $0.017 in 2025 and continue to grow to cross the $0.20 mark by 2030. However, DigitalCoinPrice’s projection sees a more moderate increase and expects AMP’s value to reach $0.0485 by 2030. As always, it’s important to exercise caution when investing in cryptocurrency and to conduct thorough research before making any decisions.

To get more details about AMP pricing, visit its webpage on our website where you can check out the price history graph in other details!

Is It Worth It to Invest in Amp?

The Amp token has quickly gained recognition in the blockchain and DeFi industry, thanks to the development and backing of the experienced Flexa team. Since 2018, they have served millions of customers globally and established a decent market presence. Notably, their smart contracts have undergone thorough testing and auditing by respected security researchers at Trail of Bits and ConsenSys Diligence.

The adoption of Amp by noteworthy projects such as Uniswap, SushiSwap, Balancer, Chainlink, and Loopring further underscores the protocol’s increasing popularity and versatility. Moreover, as the Flexa Network continues to expand and more protocols embrace Amp, the token’s liquidity and decentralization will undoubtedly improve, ultimately enhancing the collateral quality of AMP.

Also, learn how to earn from staking amp on flexa if you have made your decision!

Conclusion

As cryptocurrency continues to become more mainstream, many investors are looking toward altcoins like AMP. One key factor that sets AMP apart from other digital currencies is its strong focus on security. Thanks to the robust security measures put in place by the Flexa Network, there is a high level of confidence that AMP will remain a stable investment for the long term.

Additionally, the strong partnerships that AMP and Flexa Network have established only serve to reinforce this sense of security. However, as with all altcoins, it’s important to remember that market volatility can be a real concern. While we believe that AMP is a solid investment option, we always recommend that investors conduct their research before making investment decisions.

Comments (No)